1. Overpaying on Auto Insurance

Believe it or not, the average American family still overspends by $461/year¹ on car insurance.

Sometimes it’s even worse: I switched carriers last year and saved literally $1,300/year.

Here’s how to quickly see how much you’re being overcharged (takes maybe a couple of minutes):

- Pull up Coverage.com – it’s a free site that will compare offers for you

- Answer the questions on the page

- It’ll spit out a bunch of insurance offers for you.

That’s literally it. You’ll likely save yourself a bunch of money.

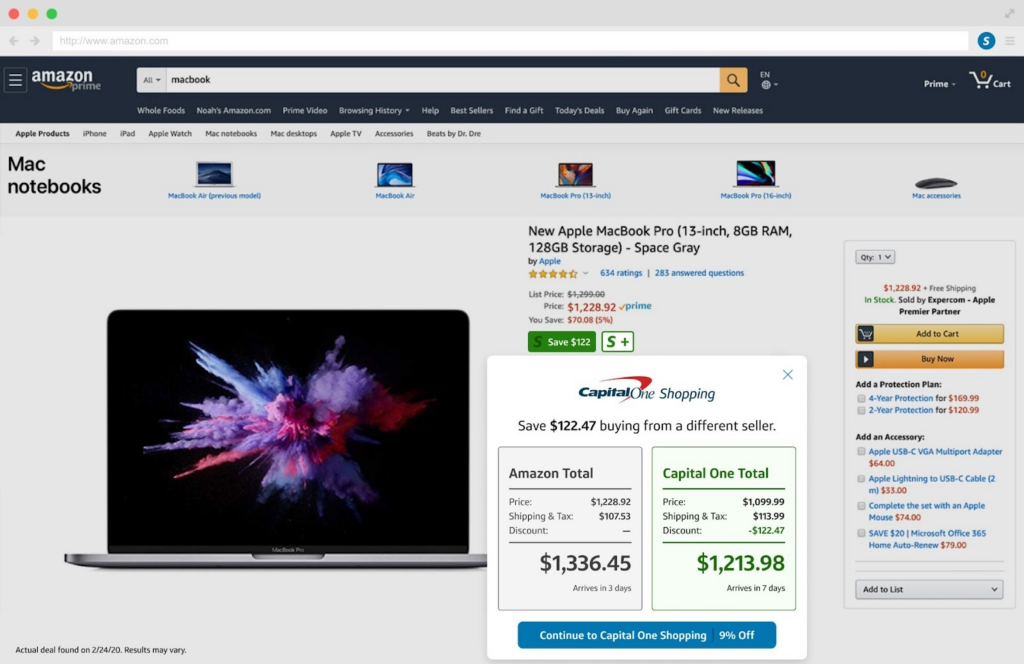

2. Overlook how much you can save when shopping online

Many people overpay when shopping online simply because price-checking across sites is time-consuming. Here is a free browser extension that can help you save money by automatically finding the better deals.

- Auto-apply coupon codes – This friendly browser add-on instantly applies any available valid coupon codes at checkout, helping you find better discounts without searching for codes.

- Compare prices across stores – If a better deal is found, it alerts you before you spend more than necessary.

Capital One Shopping users saved over $800 million in the past year, check out here if you are interested.

Disclosure: Capital One Shopping compensates us when you get the browser extension through our links.

3. Home repair bills (let a company pay them for you instead).

Picture this: your trusty furnace suddenly throws a tantrum in the dead of winter, leaving you shivering and facing a repair bill that could cost you way more than you anticipated.

If you had a home warranty, you could be covered the next time something breaks down. It’s like having a safety net for your home (think plumbing, electrical, appliances, etc).

If you don’t have one yet, Choice Home Warranty is one of the bigger companies out there.

Bonus: home warranty companies usually have qualified, pre-vetted maintenance and repair workers ready to get the job done (which is one less thing to worry about).

If you’re interested just enter your zip code here to find a home warranty plan. It could save you a bunch of money the next time something breaks down.

4. Not Investing in Real Estate (Starting at Just $20)

Real estate has long been a favorite investment of the wealthy, but owning property has often felt out of reach for many—until now.

With platforms like Ark7, you can start investing in rental properties with as little as $20 per share.

- Hands-off management – Ark7 takes care of everything, from property upkeep to rent collection.

- Seamless experience – Their award-winning app makes investing easy and efficient.

- Consistent passive income – Rental profits are automatically deposited into your account every month.

Now, you can build your own real estate portfolio without needing a fortune. Ready to get started? Explore Ark7’s properties today.

That’s all (for now).

Those are my top savings tips for the time being, but I’ll keep adding to this article as I find new tips for you.

Thanks for reading!